Real Estate Investing for you

1031 Exchanges Are Not Just For “Big” Investors

Whether you’re selling a single income-producing property or managing a portfolio of 100, a 1031 Exchange may be right for you.

What is a 1031 Exchange?

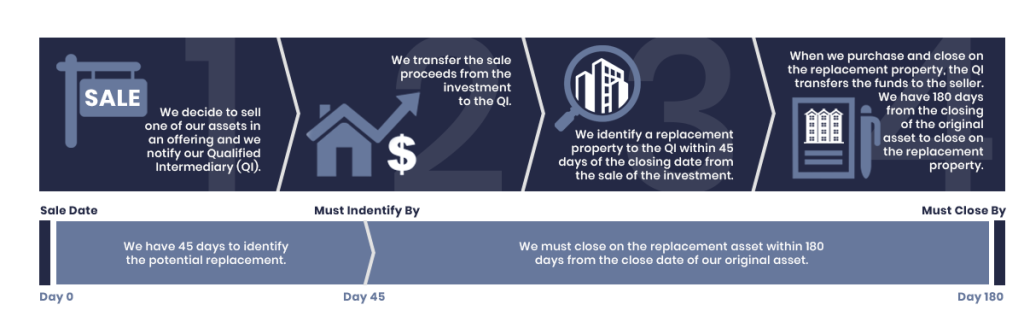

A 1031 exchange derives its name from Section 1031 of the U.S. Internal Revenue Code. This provision allows you to defer capital gains taxes when you sell an investment property and reinvest the proceeds—within specific timeframes—into a like-kind property or properties of equal or greater value.

Why Should I Do a 1031 Exchange?

Tax Deferral

A 1031 exchange allows investors to defer paying capital gains taxes on investment property sales by reinvesting the proceeds into a like-kind property.

Preserves Investment Growth

By deferring taxes, investors can leverage the full sale proceeds for their next property purchase, potentially growing their portfolio faster.

Diversification Opportunities

It provides an opportunity to diversify your investment holdings, whether by property type or location, without incurring immediate tax liability.

Estate Planning Benefits

When held until death, properties in a 1031 exchange can pass on with a stepped-up basis, potentially reducing capital gains taxes for heirs.

Understanding 1031 Exchanges

If you own an investment property and are considering selling it to purchase another, it's important to understand the 1031 tax-deferred exchange. This process enables investment property owners to sell their property and acquire a like-kind property while deferring capital gains taxes.

Consultations are always free. Curious if your property qualifies for a 1031 exchange? Contact one of our professionals today!